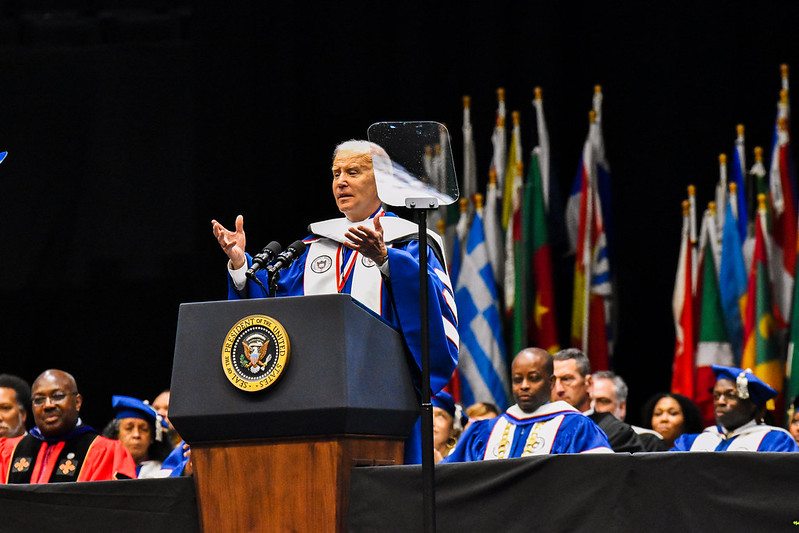

The Biden-Harris administration announced the early approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the Saving on a Valuable Education (SAVE) repayment plan last Wednesday. Initially scheduled for July, the administration is providing relief to borrowers about six months earlier than planned.

Through more than two dozen executive actions, the administration has already granted approximately $138 billion in student debt cancellation for approximately 3.9 million borrowers as of January 2024.

“Congratulations—all or a portion of your federal student loans will be forgiven because you qualify for early loan forgiveness under my Administration’s SAVE Plan,” the email message sent from Biden to eligible student loan borrowers, said.

The SAVE Plan is an income-driven payment plan, which is voluntary and bases monthly student loan payments on the borrower’s earnings, including adjustments to prevent more income from being used to calculate payments and waiving unpaid interest at the end of each month.

Regarding eligibility criteria, the administration declared that this round of student debt cancellation will be for borrowers who are enrolled in the SAVE plan, have been in repayment for at least 10 years and have taken out $12,000 or less in student loans. For every additional $1,000 initially borrowed, borrowers will receive relief after an additional year of payments.

“With [this] announcement, we are once again sending a clear message to borrowers who had low balances: if you’ve been paying for a decade, you’ve done your part, and you deserve relief,” U.S. Secretary of Education Miguel Cardona said during a White House press briefing on student debt cancellation.

The SAVE Plan is particularly beneficial to people who have larger debt amounts, according to senior Administration officials. As Black college attendees are more likely to borrow loans, have higher loan amounts on average and typically struggle to repay student loans according to the Education Data Initiative, the SAVE plan offers unique relief.

“Making student loan programs more fair is an important step toward addressing inequities in opportunities by race in our country,” a senior administration official told The Hilltop.

“We anticipate [SAVE] is going to be a powerful tool for many Black borrowers and alumni of historically Black colleges and universities to help them afford to repay their student loans or earn loan forgiveness,” the senior official said.

Dezmond Rosier is a junior political science major and economics minor from Charles County, Maryland. Rosier currently serves as the President of the College of Arts and Sciences Council and has served as Political Action Chair and Vice President for Howard’s chapter of the National Association for the Advancement of Colored People (NAACP).

While Rosier acknowledged the Biden-Harris Administration’s progress toward student debt cancellation, as a student committed to fighting for student debt cancellation, he emphasized the need for more work to be done.

“We kept the conversation alive and organizations held the administration accountable, but I do not believe the administration prioritized student debt cancellation as much as they should have,” Rosier said.

With the upcoming presidential election and Biden’s bid for re-election, young voters like Rosier are considering the impact of the administration and whether campaign promises have been met. For many college students, the prospect of additional student debt cancellation will factor prominently in their decision at the ballot box. However, there is still time left for the administration to bring necessary improvements during this term.

“Promises made should be promises kept and we should not rely on a re-election to get the job done,” Rosier said. “I want to see the administration be loud, I want to see them be bold.”

Rosier urged Howard students, and HBCU students at large, to get involved in political advocacy for student loan forgiveness.

“We are not a generation of later, but a generation of now. I highly encourage our students here at Howard to ask how to get involved so we can make education more accessible, fair and free.”

Borrowers began receiving emails from President Biden on Wednesday telling them they were approved for forgiveness, with no need for further action. According to the Biden-Harris Administration, moving forward, borrowers who are eligible for forgiveness under the SAVE Plan will have their loans automatically forgiven.

The U.S. Department of Education declared it will begin emailing borrowers who can become eligible for forgiveness if they switch to the SAVE Plan. To learn more and enroll in the SAVE repayment plan, visit studentaid.gov/save.

Copy edited by D’ara Campbell