College students struggle to afford groceries as the U.S Bureau of Labor Statistics recently reported a 13.5 percent increase in the food at home index, which is the biggest recorded increase over a 12-month period in over forty years.

“Increases in the shelter, food, and medical care indexes were the largest of many contributors to the broad-based monthly all items increase. These increases were mostly offset by a 10.6-percent decline in the gasoline index,” according to a report from the U.S Bureau of Labor Statistics.

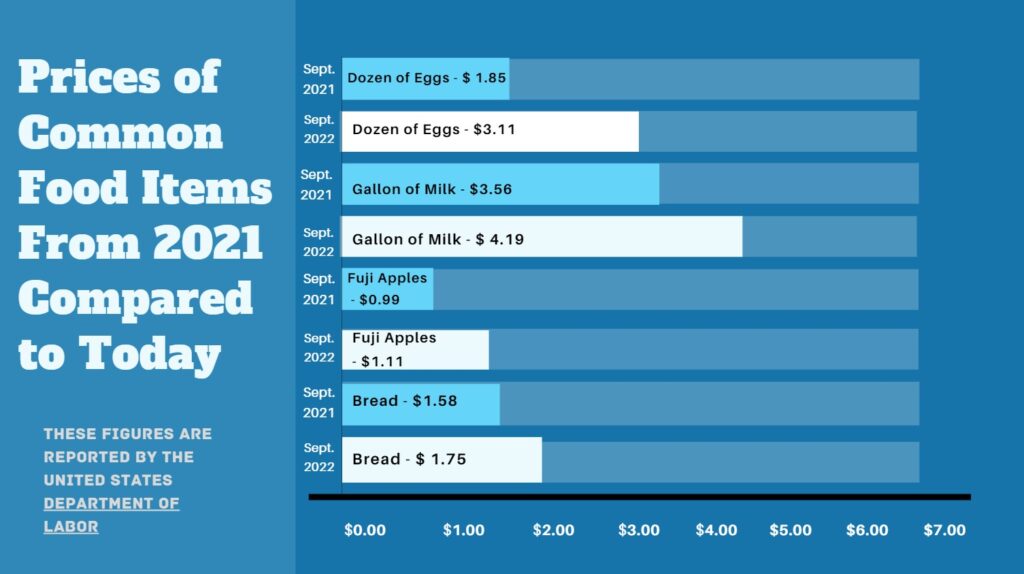

Grocery items at record highs include eggs, meats, dairy products, and fruits. Za’keira Goodwin, a political science student at Howard University who works at Giant Grocery Store, has seen the first-hand consequences of when students already on tight budgets have to cut more corners to provide food for themselves.

“I’d say inflation caused a lot of students to create a lot of unhealthy habits. More often than not now, when I am checking students out, they typically all have the same type of foods: ramen, water, frozen entrees and packaged food,” commented Goodwin.

Maintaining a healthy diet, maximizing your dollars, and finding a location within walking distance is central for students who depend on grocery stores for their meals, such as Katelyn Barker, a senior broadcast journalism major. Barker said that she has seen a significant increase in how much money she has had to spend on groceries that she feels are already overpriced.

“With prices continuing to rise, I feel that I have spent a lot more money on groceries being away from home. Being an upperclassman that lives off-campus, paying for groceries has put a significant dent in my spending money. Since I don’t have a Howard meal plan… I am not only buying snacks for myself but instead three courses to create a meal which adds up over time,” Barker added.

Of the people in Washington, D.C., between ages 16-24, according to the Oxfam Minimum Wage Model, over 70 percent make over $15 an hour compared to the national average of almost 25 percent, which is a silver lining for students who are able to work in addition to their studies to help cover their expenses.

Among students who have had to limit the number of healthy foods that they eat due to the struggle to pay for their own groceries is Olivia Blevins, who is a junior at Howard University. These students do not always live on campus, where partaking in the school meal plans is more accessible, forcing them to turn to nearby grocery stores.

“I try not to buy ramen and stuff like that, but it really depends on the cash flow for the month. I want to get more fruits and vegetables, but if I know something is cheaper and it will last me longer, sometimes I will sacrifice healthy foods for that,” said Blevins.

Students at Howard University can, however, turn to The Store@HU, where, after filling out an eligibility form, they will be notified in 2-4 business days on how to proceed with getting nutritious food for free.

As several outlets report that the Federal Reserve is preparing to raise the federal interest rate for the fifth time this year, many college students continue to feel the impacts of the steadily increasing prices of groceries as they try to survive long enough to get their degrees.

Copy edited by Nhandi Long-Shipman