President Biden recently signed into law the The Inflation Reduction Act, a landmark piece of legislation that lowers prescription drug costs, makes the largest investment in climate change in U.S. history and lowers the tax deficit — a major legislative win for the Biden Administration amid American dissatisfaction.

Among its features, the bill allows Medicare to negotiate for lowering prescription drug prices for seniors. The bill includes a $360-billion investment in domestic renewable energy production in an effort to reduce carbon emissions. It will be paid for by an increase in corporate taxes (15%), which contributes to a total of $737 billion in revenue and $437 billion will go towards energy security and climate change, drought resilience and extending the Affordable Care Act, the Congressional Budget Office and the Joint Committee on Taxation reported.

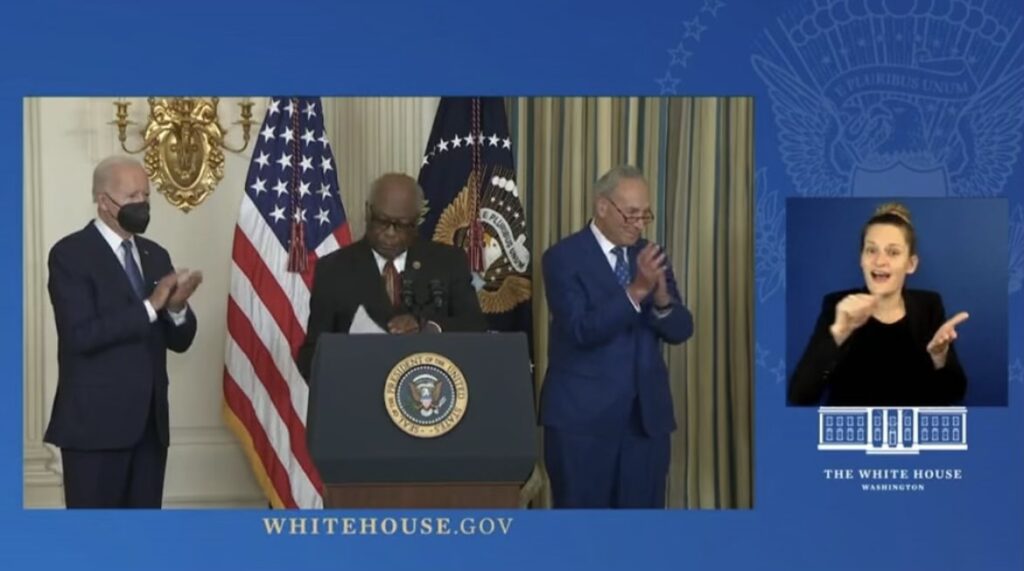

The Inflation Reduction Act passed in the Senate on Aug. 7 with Vice President Harris breaking the tie among the evenly divided 50-50 Senate. Democratic Senate Majority Leader Chuck Schumer was able to strike a deal with Democratic Senator Joe Manchin — who previously stated he wouldn’t support the bill — after monthslong negotiations as the party needed his support as a result of the slim margins.

Some of the provisions that had to be dropped through the course of negotiations included a child tax credit, free preschool, paid family leave and subsidized childcare, according to consumer finance site Go Banking Rates. The bill was then sent to the House of Representatives and passed in a 220-207 vote before finally going to President Biden.

As gas prices, food, and more have come down in recent weeks, many have questioned how this bill relates to current inflation. The White House says that it would lower inflation through the lowering of energy and health care costs and reducing the deficit. Contrarily, NPR reported that the Congressional Budget Office says the legislation will have a “negligible effect” on inflation in 2022 and 2023.

In terms of the healthcare policies in the law, Medicare will be able to negotiate prescription drug prices starting in 2026, and the subsidies included in the Affordable Care Act will continue until 2025. According to the U.S. Department of Health and Human Services, the extension will save an estimated 3 million people from losing coverage. It also prohibits, according to the Kaiser Family Foundation, 13 million people from experiencing premium price increases.

Other healthcare provisions include the out-of-pocket cost for medication being limited to $2,000 and how people will only have to pay at most $35 for insulin staring in 2025 — which could range anywhere between $120 and $400 per month. This is a provision that Dr. Patricia Talbert, an associate dean in the College of Nursing and Allied Health Sciences at Howard University, sees as a long-lasting and wide-varying impact.

“When we think about individuals who have been diagnosed with diabetes and they need their insulin to live, to be able to cap $35 out of pocket for insulin is major. Over about 3 million Americans can benefit from this provision,” Dr.Talbert said.

Other healthcare benefits of the bill include tax penalties for pharmaceutical companies/drug makers who try to charge people above the rate of inflation beginning in 2023, increased assistance for low income patients with premiums, deductibles and cost-sharing, reducing costs for an estimated 400,000 Black and Latino patients, laminating cost-sharing for adult vaccines for people on Medicaid and preventing premium increases in the future by capping the cost growth at 6% between 2024 and 2029. Some Republicans, such as Gov. Rick Scott of Florida, believe that the bill cuts Medicare benefits because of the reduction in federal spending.

“This is the guy that just applauded Dems cutting $280 BILLION from Medicare while on vacation at the beach. @JoeBiden spent decades trying to CUT Medicare & Social Security. My plan is focused on preserving them,” he said in a quote tweet to Fox News’ report of Biden saying Democrats will deliver stronger social security.

In actuality, only the prices for prescription drugs will be reduced for the American people.

The bill also seeks to make some serious investments in climate change — the largest in U.S. histories — as cities have grappled with record-breaking temperatures. The National Oceanic and Atmospheric Association reported that this July was the third hottest on record and our 1-in-1,000 year rain events occured across the west coast and midwest. Climate change provisions include $60 billion toward creating clean energy manufacturing jobs, offering tax incentives for industrial companies that invest in energy efficient technology, and for Americans who purchase electric vehicles, solar panels, heat pumps and other energy efficient resources for their homes, and $60 billion toward cleaning up disadvantaged low income communities that face pollution and reduce greenhouse carbon emissions by 2030.

In order to get majority Democrat support, changes include incentivizing fossil fuel facilities to continue operating, providing new leasing for oil and gas drilling and investing in the building of new pipelines. Democrats and environmental activists, such as Independent Vermont Senator Bernie Sanders, have pointed out these as being problematic and called it a “huge giveaway to the fossil fuel industry.’’Despite this, a study released by the Department of Energy emphasized that the potential increases in gas pollution will be “dwarfed” by the impact of the Inflation Reduction Act as well as last year’s Bipartisan Infrastructure Law.

Tax reform in this bill includes 15% for corporations making $1 billion or more and no increases for families and small businesses making $400,000 or less a year. Ahead of the 2022 midterm elections, Democrats are looking to capitalize on the momentum through promoting the bill and informing Americans of what is included. The administration also plans on unveiling an interactive digital platform where people will be able to learn about the tax credits for the climate bill, according to NPR.

Copy edited by Chanice McClover-Lee